Introduction: UK wage growth slows, but beating inflation

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

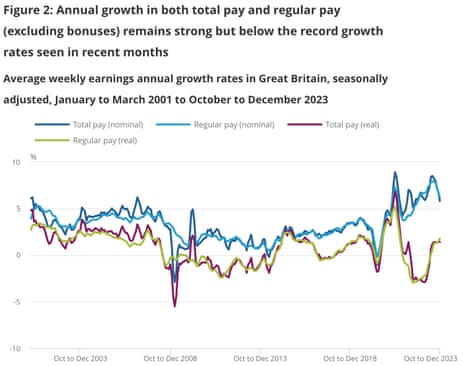

UK wage growth has slowed, as the jobs market continues to cool, but continues to outpace inflation.

Average earnings (excluding bonuses) grew by 6.2% per year in the October-December quarter, new data from the Office for National Statistics this morning shows, down from 6.7% the month earlier.

Total pay growth (including bonuses), slowed to 5.8% from 6.7%.

Both readings are higher than the City expected.

Much, but not all, of this wage growth is being eaten up by inflation, which ended 2023 at 4%.

If you strip out CPI inflation, then real total earnings rose by 1.6%, and regular pay grew by 1.9% – growth was last higher in July to September 2021.

That should help workers through the cost-of-living squeeze, but may disappoint the Bank of England which is looking for signs that inflationary pressures are easing.

Today’s jobs report also shows that the number of payrolled employees in the UK rose by 31,000 between November and December 2023, and rose by 401,000 over the year.

The unemployment rate has dropped to 3.8%, a rate last seen a year earlier in October to December 2022.

The employment rate rose to 75.0%, but the ONS warns that employment growth has slowed.

And the economic inactivity rate remains worryingly high at 21.9%, having been driven up last year by a rise in long-term sickness.

ONS director of economic statistics Liz McKeown says:

“It is clear that growth in employment has slowed over the past year. Over the same period the proportion of people neither working nor looking for work has risen, with historically high numbers of people saying they are long-term sick.

“Job vacancies fell again, for the nineteenth consecutive month. However, there are signs this trend may now be slowing.

“The number of days lost to strikes went up in December, with the majority coming from the health sector.

“In cash terms earnings are growing more slowly than in recent months, but in real terms they remain positive, thanks to falling inflation.”

The agenda

-

7am GMT: UK labour market report

-

10am GMT: ZEW index of eurozone economic sentiment index

-

1.30pm GMT: US inflation report for January

Key events

Oil cartel Opec is sticking with its forecast for higher demand over the next two years.

In its latest monthly report, Opec forecasts global oil demand growth of 2.2m barrels per day in 2024, and 1.8m barrels per day in 2025.

Opec has also nudged up its estimates for world economic growth this year to 2.7%, up from 2.6%, and to 2.9% in 2025, from 2.8%.

The report says:

Global economic growth exceeded expectations in both 3Q23 and 4Q23, and the consistent momentum towards the end of the year is expected to carry over into 2024.

UK housing market has “turned the page” in January

The UK property market strengthened in January, new data from estate agent Hamptons shows.

Hamptons reports that there’s been a steep fall in the number of price reductions, while the pressure on sellers to accept offers below their asking price fell as houses sold faster than a year ago.

Here’s the details:

-

In January, sellers were less likely to cut their asking price than at any time over the last eight months. 48% of homes sold in January across England & Wales had been subject to a price reduction, down from a peak of 55% in October 2023.

-

The average seller in England & Wales sold their home last month for 98.9% of their asking price, up from 98.5% in both December 2023 and January 2023.

-

9% of homes that came onto the market in January sold within a week, up from 6% in January 2023… but lower than in January 2021 when 19% of homes sold within a week.

Aneisha Beveridge, head of research at Hamptons, said:

“The early signs in 2024 suggest that the market has firmly turned the page. Falling mortgage rates have been the primary catalyst, tempting last year’s missing movers to restart their property search. Consequently, more households were looking to buy last month than in any January over the last decade, including the start of both 2021 and 2022.

“First-time buyers and second steppers, who tend to be most reliant on mortgage finance, are at the forefront of the recovery. This injection of demand is starting to stabilise house price falls, particularly for mid to lower-priced homes, which should also improve selling conditions further up the chain as the year progresses. That said, the affordability picture is still more challenging than it was a few years ago which will keep a tight lid on price growth.”

Kevin Boscher, chief investment officer at investment group Ravenscroft, predicts the first UK interest rate cut will come in May – with up to one percentage point of cuts coming this year:

Whilst inflation surprises positively and hits its 2% target earlier than expected, we think the MPC will remain cautious given “sticky” services inflation, rising disposable incomes and wage inflation which is still on the high side although falling rapidly.

We expect the MPC to cut rates by 0.75%-1% this year starting in May.

Global investors are more optimistic that the world economy will avoid being driven into recession by high borrowing costs.

The latest poll of investors, from Bank of America, has found that 62% of respondents think the US economy will stay robust, surging up from 28% last month.

The proportion expecting an immediate US slowdown due to monetary tightening (high interest rates) has almost halved, falling from 61% to 32%.

Growth pessimism in Europe remains pronounced, however, with 62% expecting a weaker European economy given the drag from monetary tightening, down from 83% last month.

Troubled social housing investor Home REIT has told the City that it is being investigated by the Financial Conduct Authority.

The FCA has begun an investigation, covering the period from 22 September 2020 to 3 January 2023, Home REIT says, adding:

Naturally, the Company will cooperate fully with the FCA in its work.

Home REIT invests in the provision of sheltered housing for homeless people throughout the UK.

Last year it fell into crisis as tenants withheld rent due to problems with its properties, such as black mould and leaking ceilings.

It has also been targetted by short sellers, with one claiming its properties were overvalued and questioned its tenants’ ability to pay rent.

Home REIT’s shares have been suspended since the start of January 2023, after it missed the deadline to publish its annual report.

Some shareholders have claimed that Home REIT misled the market, and are bringing legal action against the company.

Oil hits two-week high

Fears that the Middle East crisis could push up inflation may deter the Bank of England from early interest rate cuts.

And policymakers will have noted that the oil price has hit its highest level in over two weeks this morning.

Brent crude has climbed by over 1%, to as high as $82.95 per barrel, the highest since 30 January.

Analysts at SP Angel Energy say:

Crude oil prices remain elevated as Israel’s military ramp-up strikes in Gaza targeting the southern city of Rafah, with the Houthis also continuing their attacks on vessels in the Red Sea.

The Bank of England will cut interest rates in June, predicts Kallum Pickering, senior economist at Berenberg bank.

Overall, he forecasts five quarter-point cuts this year, as pay growth continues to slow.

So far, the BoE has managed to pull off a mostly soft landing for the economy, while enabling a Goldilocks scenario for the labour market. But it is too soon to declare a complete victory.

Even though money market rates have fallen in anticipation of forthcoming rate cuts, past rate hikes are still feeding through the housing market and to businesses that are rolling over debt. To keep the labour market on track and to underpin a broader recovery in economic activity in 2024, the BoE will need to start to take its foot off the brake soon.

A likely further easing of wage growth over coming months should give BoE policymakers the confidence to start cutting rates from Q2 onwards. We continue to look for the first 25bp cut in June and five cuts overall in 2024 – lowering the bank rate from 5.25% to 4% by year-end.

Sam Tombs, chief UK economist at Pantheon Macroeconomics, shows here how rising sickness levels have pushed more people out of the jobs market:

The number of Brits who are economically inactive due to long-term sickness rose by a further 189K over the course of 2023, depleting the workforce by 0.5%. The economy’s prospects would improve greatly if healthcare waiting lists can be stabilised or reduced. pic.twitter.com/dXXTdsbLTS

— Samuel Tombs (@samueltombs) February 13, 2024

The Bank of England is next due to set interest rates on 21 March.

The money markets currently indicate there’s a 95% chance that the BoE leaves rates on hold at 5.25%, and just a 5% chance of a cut.

At this month’s meeting, its monetary policy committee split 6-2-1, with six members voting to hold rates, two voting for a rise and one for a cut.

Deutsche Bank: Jobs data won’t help rate cut hopes

Today’s labour market won’t be good news for doves at the Bank of England who hope to cut UK interest rates soon, says Sanjay Raja, Deutsche Bank’s chief UK economist.

Raja points to the drop in the unemployment rate to 3.8%, from 3.9%, and the stronger-than-expected wage growth:

The jobless rate – for what it’s worth – inched lower. Wage growth was a little stickier than we anticipated. And vacancies didn’t see the drop we expected.

Overall, today’s data leans more hawkishly for an MPC looking for sufficient evidence that the labour market is cooling

He adds:

Despite the slowdown in pay growth, today’s wage data leans a little more hawkishly – the MPC was projecting private sector pay growth to slip to 6% (3m/YoY) in Dec-23. (instead, it was 6.2%, as covered at 8.12am).

It’s now all up to the inflation data (7am tomorrow) to see whether spring rate cuts could still be on the table.

Amazon staff in Coventry walk out on ‘Valentine’s Day’ strike

Amazon workers in Coventry have gone on a three-day strike in a long-running dispute over pay.

More than 1,000 GMB union members are striking until Thursday, to coincide with Valentine’s Day tomorrow.

Staff are demanding a pay increase to £15 an hour and the right to negotiate with the company over pay and conditions.

The strike comes after the GMB accused Amazon of resorting to “union-busting” tactics at its warehouses in the Midlands, with workplace message boards telling staff: “We want to speak with you. A union wants to speak for you.”

Traders cut bets on UK rate cuts after today’s wage data

In the City, traders have been dialling back their forecast for how many times the Bank of England will cut interest rates this year.

Reuters reports that UK rate futures now predict 69 basis points of cuts this year, or slightly less than three quarter-point rate cuts.

Previously, the City had forecast 78bps of cuts this year, meaning cuts to 4.5% by December – from 5.25% today – had been fully priced in (but aren’t any more).

UK Rate Futures Point To 69 Basis Points Of Bank of England Rate Cuts By December Compared With 78 Bps Before Labour Market Data

— First Squawk (@FirstSquawk) February 13, 2024

Tui has reported a surprise profit and record revenues in the Christmas quarter, as investors in Europe’s biggest travel operator prepare to vote on plans to delist the company from the London Stock Exchange.

The executive and supervisory board of Tui, which is listed on the FTSE 250 and in Frankfurt, has recommended that shareholders vote in favour of a single listing in Germany at the company’s annual general meeting on Tuesday.

Shares in TUI have risen 3% in early trading.

Victoria Scholar, head of investment at interactive investor, says:

Despite pressures from the cost-of-living crisis, individuals and families continue to prioritise their trips abroad. Tui has managed to uphold demand even while simultaneously increasing prices, highlighting how the business holds significant pricing power to pass on additional cost pressures to consumers.

Meanwhile, the London Stock Exchange could be bracing for yet another blow, as Tui prepares to decide on whether to abandon its London listing. The travel operator is just the latest in a slew of businesses considering fleeing the LSE, to list in rival financial hubs instead like New York or Frankfurt. This comes after a period of weak price action in the UK post Brexit, resulting in discounted valuations for UK stocks.

Just this week shares in Arm have taken to the skies in New York, a painful reminder of that nasty blow to London’s public markets.”

Analysis: Buoyant UK labour market data belies rise in long-term sickness

Larry Elliott

On the face of it, Britain’s labour market is in rude health, but the underlying picture is less cheery, our economics editor Larry Elliott explains:

Employment rose in the final three months of 2023 and unemployment fell to 3.8%. Earnings, adjusted for inflation, rose for a sixth successive month. All are traditionally signs of strength – not an economy that may well have been in recession in the second half of last year.

Scratch beneath the surface and things look less rosy. The latest bulletin from the Office for National Statistics (ONS) reveals that one reason the jobs market is running so hot is because of a lack of workers caused by long-term ill-health. The number of people inactive for health reasons was 2.8 million by the end of 2023 – a rise of more than 200,000 on the year and a jump of 700,000 since before the Covid pandemic. In a literal sense, this is a sick economy.

The absence from the labour market of so many potential workers has consequences. There are still a high number of job vacancies, even though the economy has been flatlining for the best part of two years. While vacancies have been on a downward trend throughout this period, at 932,000 they are still above pre-Covid levels.

More here.

UK employers are trying to plug gaps in their workforces by employing more people from overseas, today’s labour market report suggests.

Simon French, chief economist at City firm Panmure Gordon, has created these charts showing the details:

Lots of sub level labour market indicators using the new LMS methodology. This one (below) on employment changes since end 2019 tells a story of extraordinary growth in non-EU born employment (up more than 1.2m), and UK & EU employment down by a combined 1.0m. pic.twitter.com/nXfLX1Wkzu

— Simon French (@shjfrench) February 13, 2024

Whatever the narrative of recent labour market and population flows – the actual data (with obvious sampling caveats) suggests that non-EU born individuals have seen a remarkable increase in contribution to the UK labour market over the last four years. https://t.co/RsZPIQxqoa

— Simon French (@shjfrench) February 13, 2024

Full story: UK pay growth slows less than expected as workers bid up wages

Pay growth slowed less than expected in December as workers continued to bid up their wages amid skills shortages and a record number of people with long-term sickness, my colleague Phillip Inman writes.

The Office for National Statistics (ONS) said annual growth in regular earnings, excluding bonuses, was 6.2% in October to December 2023, while pay rises including bonuses was 5.8%.

City economists expected average earnings in the UK to drop significantly in the three months to December to 6% excluding bonuses and 5.6% including bonuses.

The modest fall will pose a dilemma for the Bank of England, which has signalled that pay rises need to moderate before it cuts interest rates.

After wages were adjusted for inflation, the ONS said workers enjoyed a fourth month of real wage increases. Total pay rose on the year by 1.6% above the consumer prices index and regular pay rose on the year by 1.9% in October to December 2023.

More here:

TUC: Conservative legacy is low pay, ill health and more insecure jobs

There was an increase in the number of people dropping out of the labour market because they were long-term sick in October-December, and also because they were students.

The number of those classed as economically inactive in the jobs market rose to 9.3 million in the final quarter of last year, with another jump in those off work due to long-term sickness, to a record 2.8 million, up 8.4% year on year.

The number of people economically inactive because they were looking after the family or home, or temporarily sick, fell – leaving the overall inactivity rate unchanged at 21.5%.

TUC general secretary Paul Nowak says:

“These figures show how people’s lives are being held back by the government’s failure to invest in our NHS.

2.8 million people are out of work because of long-term sickness and the numbers are still rising.

“Average pay is still worth £12 a week less than before the financial crisis 16 years ago and more than a million people are on zero hours contracts. The Conservative legacy is low pay, ill health and more job insecurity.

“It’s time for change. We need a proper plan for jobs, growth and public services to get living standards rising sustainably again.”