Economists: UK still at risk of technical recession.

Several economists are warning that the UK could have slid into a technical recession at the end of last year, even though the economy grew by 0.3% in November.

Britian would be in a technical recession if growth contracted in October-December for the second quarter running.

A technical recession would be a blow to the government ahead of the next election, even though the ONS are arguing that two small drops in quarterly GDP are not a full-blown downturn, as covered earlier.

Yael Selfin, chief economist at KPMG UK, says strike action in December will have hit GDP at the end of last year:

“The economic outlook currently remains gloomy, with a technical recession still potentially on the cards in the second half of 2023, especially given the expected impact from the industrial action in December.

Nonetheless, even if the economy manages to avoid a recession, it is expected to remain in stagnation territory.

Richard Carter, head of fixed interest research at Quilter Cheviot, says the UK remains on the brink of recession, as high interest rates hit growth:

“The UK economy grew by a modestly positive 0.3% month-on-month in November, up from the unexpected 0.3% contraction seen in October. This uplift in November is just enough to bring the UK economy back to flat growth over these two months, but it leaves an awful lot of pressure on the December figures as even a slight downward turn would result in the UK entering a technical recession after Q3 GDP was revised down to a fall of 0.1% at the end of last year.

“This morning’s figure shows just how precarious the situation is for the UK economy and piles yet more pressure onto the Bank of England to cut interest rates. The Bank has managed not to tip the UK into a recession to date, but it is looking increasingly likely that its luck may be coming to an end.

Suren Thiru, economics director at ICAEW, says the case for cutting UK interest rates soon is growing, as the economy struggles to gain momentum.

“November’s rebound may have been insufficient to prevent a small technical recession at the end of 2023, with the cost-of-living squeeze and high borrowing costs likely to have constrained output in December.

“The UK is facing a notably difficult 2024 with the lagged impact of previous interest rate rises, weaker consumer demand and moderately higher unemployment likely to stifle economic activity, despite a boost from lower inflation.

“This lacklustre GDP outturn means that interest rates will remain on hold next month. With the UK teetering on the brink of recession and inflation slowing, the case for loosening policy sooner rather than later is growing.”

Neil Birrell, chief investment officer at Premier Miton Investors, agrees that the economy may have contracted in Q4.

“The UK economy returned to growth in November, although this may not prevent the fourth quarter of 2023 being another one of contraction.

Whether the economy slides into a mild recession or not is unlikely to matter too much, but there is not much momentum moving into 2024.

However, given the inflation and interest rate pressures, this is a creditable performance and with rate cuts in the pipeline and an election looming, there is some stimulus on the way.”

Key events

Brent crude is continuing to rise – it’s now up 4% today, or $3 per barrel, to $80.50 per barrel.

Bloomberg are reporting that Danish fuel-tanker company Torm is halting all transits through the southern Red Sea in the wake of air strikes on Yemen.

They add:

The decision is in line with notices from industry trade groups who’ve said that military guidance is to avoid the area. Torm owns a fleet of about 80 ships.

At least four oil tankers have diverted course from the Red Sea since overnight strikes by the U.S. and Britain on Houthi targets in Yemen, according to Reuters, citing shipping data from LSEG and Kpler.

They add:

The tankers Toya, Diyyinah-I, Stolt Zulu and Navig8 Pride LHJ were all seen turning around mid-voyage in order to avoid the Red Sea between 0300 and 0730 GMT on Friday, according to ship tracking from the two companies.

One of the tankers, Toya, a very large crude carrier capable of carrying up to 2 million barrels of oil, was unladen, the data showed. The other three vessels are fuel tankers.

Allianz Trade, the international insurance company, believe the Red Sea crisis is not, yet, not a red flag for the global economy.

In a new research note, they point out that while shipping has been disrupted, prices are still some way below their levels when the Covid-19 pandemic hurt supply chains.

Ana Boata, head of macroeconomic research at Allianz Trade, says:

Due to the attacks, shipping volume in the Suez Canal declined by -15% year-on-year in the ten days leading up to Jan 7, while it dropped by -53% in the Bab-el-Mandeb Strait leading into the Red Sea.

The number of cargo ships decreased by -30% for cargo and -19% for tankers via the Suez Canal. Meanwhile, during the same period, shipping volume around the Cape of Good Hope nearly doubled, with cargo ships increasing by +66% and tankers by +65%.

Although shipping prices and especially container freight prices have increased significantly since November 2023 (+240% as of early January – see Figure1), prices are only a quarter of the peak seen in 2021 and as the demand backdrop remains weak, inventories are higher in most consumer good segments and the shipping sector has built up more capacities with new containerships, the upside risk seems lower today than in 2021.

Boata also explains how the Red Sea crisis could push up inflation, and hurt growth.

Unsurprisingly, the impact from rising shipping costs on inflation is highest in Europe and the US where a doubling of shipping costs pushes inflation up by +0.7pp (percentage points) compared to +0.3pp for China.

For global inflation, this would mean an increase of +0.5pp to 5.1% in 2024. For GDP growth this could translate into -0.9pp for Europe and -0.6pp for the US. This could translate into a loss of -0.4pp to global GDP growth to 2%.

Brent crude hits $80 for first time this year

Newsflash: the Brent crude oil price has hit $80 per barrel for the first time since 27th December.

Brent is now up almost 3.5% today at $80.10, after the US and UK attacks on Houthi-controlled areas of Yemen overnight.

*BRENT OIL HITS $80 AFTER AIRSTRIKES TARGET YEMEN’S HOUTHIS

— IG (@IGcom) January 12, 2024

Analysts at Saxo say:

Oil prices surged back to upper end of the current range, in Brent around $80, after the US and UK launched airstrikes against Houthi rebel targets in Yemen, and Iran also raised stakes as its Navy captured an oil tanker off the coast of Oman.

The gold price, often a safe-haven in troubled times, has risen a little today.

Gold is up 0.6% at $2,040 per ounce.

Marios Hadjikyriacos, senior investment analyst at XM, says the airstrikes against Yemen have boosted oil and gold.

With tensions in the Middle East already sky-high, this military strike fanned fears about a broader escalation in the region, which translated into a boost for oil and gold prices.

That said, this conflict has had little direct impact on oil production so far, so it’s questionable whether such concerns will support prices for long without further escalation that actually takes some crude barrels offline.

Shares in aerospace and defence companies are rising today too.

Weapons and combat vehicle maker BAE Systems has jumped 1.6% in London this morning. Rolls-Royce, which makes and services military engines, is up 2%.

French aircraft equipment manufacturer Safran, which makes landing gear, wheels, brakes, wiring, avionics and navigation systems, are up 3.1% in Paris.

Airbus, which makes military aircraft, are up 2.4%, while Thales – which makes a range of defence products – are 1.4% higher.

Oil could keep rising if tensions escalate further in the Middle East, warns Ricardo Evangelista, senior analyst at ActivTrades:

Evangelista explains:

Brent oil prices rose more than 3% over the last 24 hours as the markets reacted to an attack by British and American forces on Houthi targets in Yemen. The strikes came as a response to the militants’ attacks on transport ships crossing the Strait of Hormuz in the Red Sea, which they claim to be a legitimate form to pressurise Israel to halt operations in Gaza.

This attack is another escalation in the tensions that have been simmering in the Middle East since the October 7 Hamas attack, and the markets are reacting with apprehension. The Red Sea route, which leads to the Suez Canal, is crossed by the main shipping lanes between Asia and the West and is the main export route for Gulf oil.

With one of the most critical oil supply channels to the West under threat, it is not surprising to see crude prices rising in a dynamic that could create further upside for the price of the barrel should tensions continue to escalate in the Middle East.

Such an outcome would worry central bankers, as it would undermine efforts to bring down inflation to levels where interest rates can safely be cut….

Oil up as Middle East tensions increase

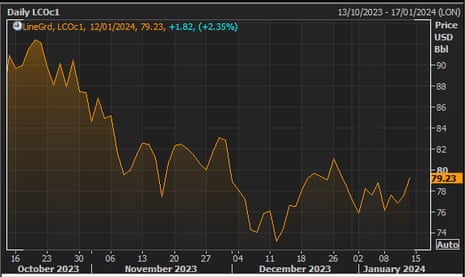

Oil is trading at its highest level in two weeks this morning, following the US and UK attacks on Houthi military targets in Yemen.

Brent crude, the industry benchmark, has jumped by 2.3% so far today to around $79.30 per barrel, its highest level since 28 December.

Oil had surged over $90 per barrel in the aftermath of the 7 October attacks. It then slipped towards the end of last year on forecasts of weak economic growth in 2024, meaning less demand for energy

Sophie Lund-Yates, lead equity analyst at Hargreaves Lansdown, says:

Brent crude has risen more than 2% to over $79 a barrel, as geopolitical tensions increase in the Middle East. Iran has captured an oil tanker off the coast of Oman in response to sanctions, according to reports.

Air strikes on Houthi targets in Yemen have also increased anxiety.

As flagged earlier (see here), Tesla is suspending most car production at its factory near Berlin for two weeks, due to delays to component shipments caused by attacks on vessels in the Red Sea.

Those tensions have prompted shipping firms to take the longer route around Africa, leading to delays.

Fusion Risk Management director of Third Party Risk Management Wes Loeffler warns that other firms will encounter similar problems, saying:

Organisations that have not established redundancies within their supply chains are likely to encounter delays, disruptions, or difficulties in procuring essential components that are necessary for delivering goods and services.

Mohamed El-Erian, president of Queens’ College, Cambridge and chief economic adviser at the financial giant Allianz, has also warned the UK “might have slipped into a slight technical recession in the second half of 2023”.

Powered by the services sector and also retail, the #UK economy grew by 0.3% in November.

This is better than the consensus forecast of 0.2%, reverses the 0.3% GDP fall in October, but doesn’t yet exclude the possibility that the #economy might have slipped into a slight…— Mohamed A. El-Erian (@elerianm) January 12, 2024

BBC: Red Sea attacks could shrink economy, warns Treasury

The BBC are reporting that the UK government is concerned that ongoing attacks on shipping in the Red Sea could cause the economy to shrink.

They say:

The BBC understands the Treasury has modelled scenarios including crude oil prices rising by more than $10 a barrel and a 25% increase in natural gas.

The government fears if the disruption to cargo traffic spreads to tanker traffic then another energy shock is possible.

Here’s the BBC’s Faisal Islam:

The impact from Red Sea cargo trade rerouting has been disruptive but not crisis-inducing… if the disruption spreads to Gulf/ Straits of Hormuz tankers (of oil AND gas) then that could well prompt a more serious spike in energy prices/ renewed & prolonged inflation shock…

— Faisal Islam (@faisalislam) January 12, 2024

Europe and the world is now more dependent on especially Qatari exports of Liquefied Natural Gas, because the Russian pipelines have been switched off – they all come through the Straits of Hormuz

— Faisal Islam (@faisalislam) January 12, 2024

As flagged earlier, the Brent crude oil price has jumped around 2% this morning, to $79 per barrel.

That’s a two-week high, but still lower than the highs over $120/barrel seen after Russia’s invasion of Ukraine in spring 2022.

Goldman Sachs has lowered its forecast for Britain’s 2024 economic growth forecast to 0.5% from an earlier expectation of 0.6%, Reuters reports.

Goldman trim their 2024 UK GDP growth forecast to 0.5% from 0.6% prior – sell-side consensus sits at 0.3%, BoE f’cast stagnation, OBR at 0.7%

— Michael Brown (@MrMBrown) January 12, 2024

The Unite union warns that today’s GDP report shows the country is “teetering on the brink after a decade of economic mismanagement”, and needs “intensive care”.

Unite general secretary Sharon Graham said:

“Today’s figures only confirm what workers see and hear every single day. Our economy needs intensive care as the result of low investment, crumbling infrastructure and a cost-of-living crisis which makes daily life unaffordable.

“This is a result of choices made by our politicians over many years. It’s time we invested to improve the economy for the benefit of all”.